- INCURRED EXPENSES INVOICE HOW TO

- INCURRED EXPENSES INVOICE UPDATE

- INCURRED EXPENSES INVOICE FULL

- INCURRED EXPENSES INVOICE SOFTWARE

INCURRED EXPENSES INVOICE UPDATE

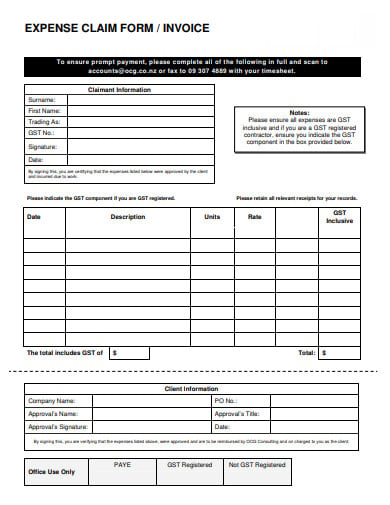

You can then record the saved amount as an unexpected profit and update the totals of available cash reserves. You can move this item out of accounts payable to the paid section. In some cases, you may have budgeted a certain amount for an acquired cost but received a lesser charge. What if you pay less for an acquired cost than the amount you budgeted for it?

This helps ensure that you maintain an accurate total of current company cash reserves. It's important to remember to move an entry from the accounts payable to the paid section once the company has paid for the good or service. Accountants generally report this data and preserve it for specific fiscal periods.

INCURRED EXPENSES INVOICE SOFTWARE

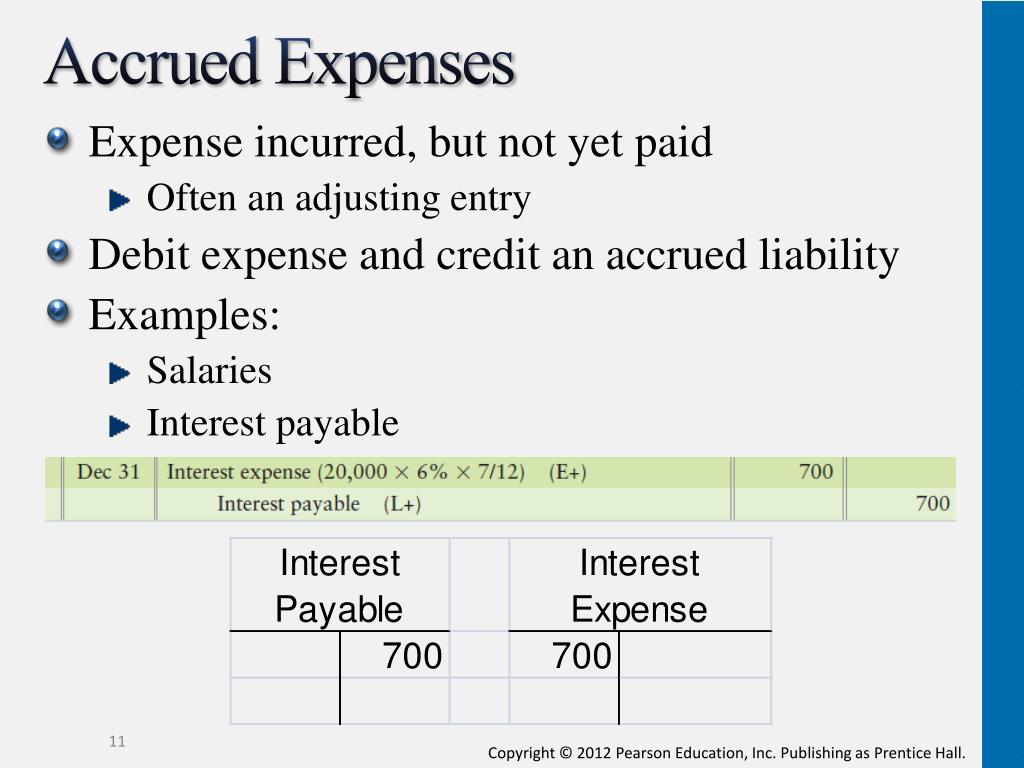

You can record these as accrued costs in a spreadsheet or accounting software platform.

INCURRED EXPENSES INVOICE HOW TO

Here are the answers to some frequently asked questions regarding expenditures and how to classify them: How do you record assumed costs? Related: How to Calculate Net Profit Margin (With Examples) Incurred costs FAQĪs business costs can vary so widely based on industry-specific factors and operating procedures, it can be helpful to review information relevant to your situation if you want to gain a more thorough understanding of proper expense classification.

Careful record keeping can also help ensure a business doesn't acquire more expenses than it is able to pay. Staying aware of acquired expense levels can help you track how much money a business currently has available to pay its bills and make further purchases. As incurred expenses represent how much a business owes in monthly or one-time charges at a given time, accountants can use these figures to determine a company's financial condition. Why are these expenses important?Ī company that maintains precise records of expenditures as it acquires them gains several advantages. In this way, you can keep the financial records up to date and be aware of how much money is available at a given time. At the time of payment, you can move it to the paid section of your files.

INCURRED EXPENSES INVOICE FULL

A paid expense, by contrast, represents one that a company has paid the full balance of, with nothing left owing. The company acquires an expense when it consumes an asset.

paid expensesĪ company's incurred expenses represent what it orders and receives a bill or invoice for but hasn't yet paid. Related: What Are Accounting Transactions? (Definition and Examples) Incurred expenses vs. It's important that accountants record these costs at the time a business incurs them to ensure it has enough cash flow to cover expenditures at any given time. To save time and paperwork, they often receive goods or services on credit and defer payment to a later date. Businesses can incur a variety of costs while producing goods and managing daily operations. Incurred expenses are fees that a business hasn't yet paid, representing items or services purchased on credit. Related: What Is Revenue? (Definition, Types and Examples) What are incurred expenses? In this article, we define incurred expenses, compare them with paid expenses, review why these expenses are important, answer some frequently asked expense-related questions, and provide examples of common acquired costs. If you're responsible for managing a business's finances, you may want to learn more about how to record expenses properly as they occur. They commonly establish relationships with suppliers and receive invoices to defer payment for delivered goods instead of paying at the time of delivery. Companies often make purchases of equipment, materials, or other assets to perform activities.

0 kommentar(er)

0 kommentar(er)